Abu Dhabi, UAE: Abu Dhabi Commercial Bank PJSC (“ADCB” or the “Bank”) today reported its financial results for the first quarter of 2023 (“Q1’23”).

Solid performance driven by core income

generation and strong fundamentals

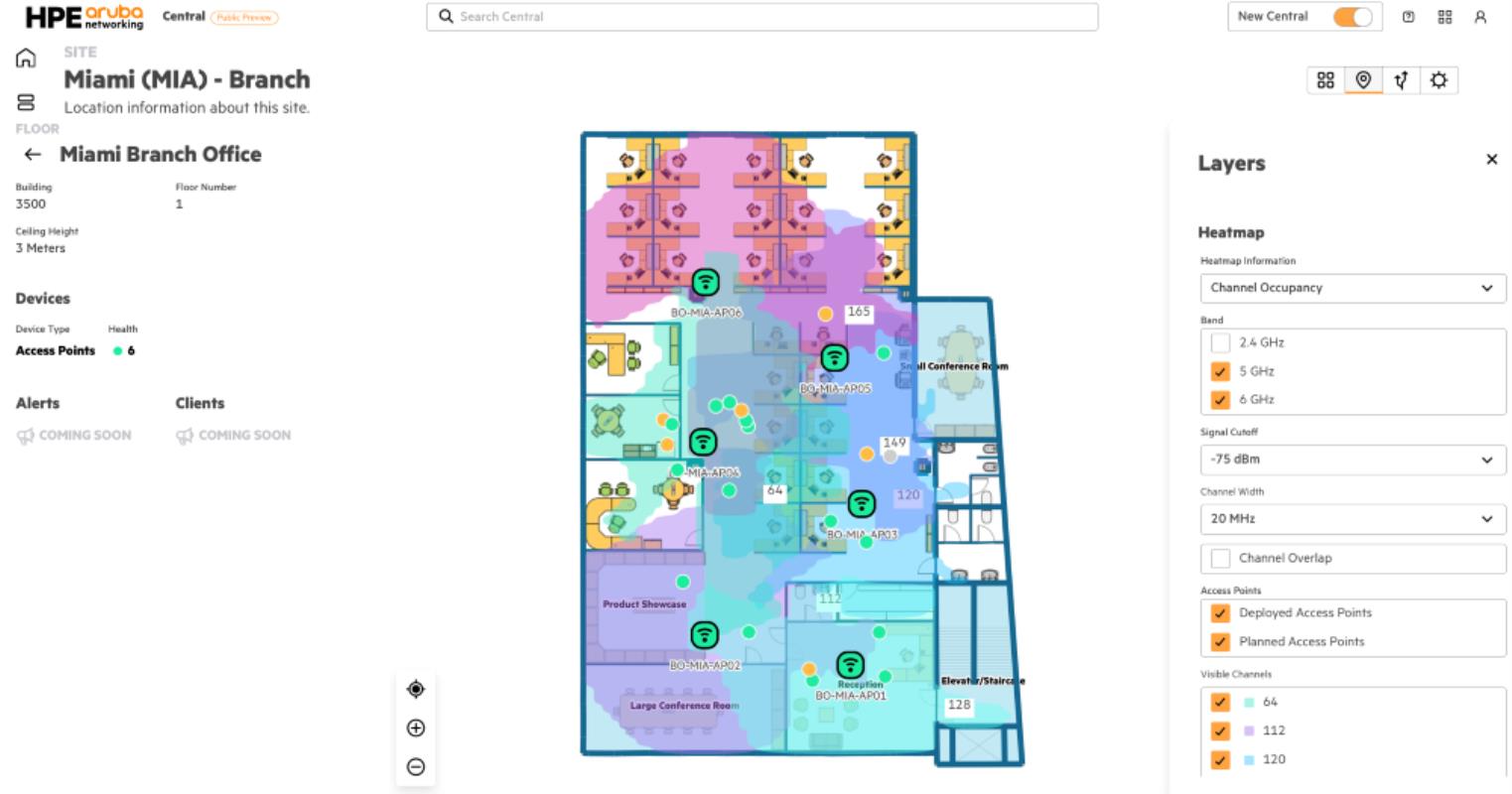

Q1’23 Key highlights (vs. Q1’22)

> Net profit of AED 1.878 bn increased 27%

> Net interest income of AED 2.851 bn increased 33%

> Non-interest income of AED 1.061 bn increased 34%

> Operating income of AED 3.912 bn increased 33%

> Cost to income ratio of 31.5% improved by 660 bps

> Operating profit before impairment charge of AED 2.681 bn increased 47%

Total assets cross the AED 500 bn mark, with continued loan and deposit growth

> Total assets of AED 501 bn increased 13% from Mar’22 and 1% from Dec’22

> Net loans of AED 264 bn were 7% higher from Mar’22 and up 2% from Dec’22. New credit extended totalled AED 20 bn in the first quarter

> Total customer deposits of AED 311 bn were 19% higher from Mar’22 and up 1% from Dec’22. CASA (Current and savings account) deposits were up AED 5 billion during the quarter to AED 158 bn, comprising 51% of total customer deposits at March-end

> Capital adequacy and CET1 ratios were 15.67% and 12.93% respectively

> Liquidity coverage ratio (LCR) of 132.9%

> Cost of risk was 75 basis point for Q1’23. NPL ratio was at 5.42% (6.06% including POCI), while provision coverage ratio was 92.4% (143% including collateral held)

ALA’A ERAIQAT

Group Chief Executive Officer

“ADCB has maintained its growth momentum into 2023, delivering a 27% year-on-year increase in net profit to AED 1.878 billion in Q1’23, which equates to a return on average tangible equity of 14.3%.

We are pleased to achieve these record quarterly results, especially in light of the heightened uncertainty in the global economy and international banking sector. ADCB’s performance is being driven by a solid balance sheet, prudent risk management, and a resilient UAE economy that benefits from strong long-term fundamentals.

The Bank has continued to deliver credit growth and our strong reputation in the market has attracted further deposit inflows. Total assets crossed the AED 500 billion mark during the first quarter for the first time, solidifying ADCB’s standing as a leading UAE financial institution.

Growth is being generated across all our business segments. It is powered by a market-leading digital offering, with ADCB listed as the only financial institution included in the top five brands in KPMG’s UAE Customer Experience Excellence Report. The Bank is taking further steps to drive digital-enabled growth, delivering a number of new partnerships this year to provide our customers with exclusive opportunities in the UAE and internationally.

In the first quarter, ADCB welcomed over 114,000 new retail customers, with 80% joining through our digital channels. Our cards business, personal and auto loans and mortgages provided combined asset growth of 11% year on year (1), reflecting positive consumer sentiment and ADCB’s ability to remain closely attuned to the market. The Bank experienced its fastest pace of growth in credit card issuance, with the recently launched ‘365 Cashback Card’ achieving record sales in its first month.

The Corporate and Investment Banking Group also continues to expand and diversify its loan portfolio. Furthermore, the business is building a strong track record in structuring complex transactions, loan syndications and capital markets advisory. The Bank has been active on a number of significant equity and debt capital raising transactions for our clients in the first quarter.

Our first quarter performance demonstrates that ADCB continues to be a highly trusted partner in the UAE economy, supported by our sharp focus on customer service excellence. The Bank benefits from a strong financial position and remains on a positive growth trajectory.”

DEEPAK KHULLAR

Group Chief Financial Officer

“ADCB has continued to display strong business and financial fundamentals. In the first quarter, the Bank achieved steady loan and deposit growth, with efficiency metrics trending in line with our medium-term guidance.

Net interest income of AED 2.851 billion was 33% higher than a year earlier, while non-interest income was up 34% at AED 1.061 billion. Operating profit before impairment allowances was up 47% year on year at AED 2.681 billion.

Given the global economic slowdown, the Bank recognises the importance of maintaining balance sheet strength to enhance long-term resilience. ADCB retains substantial capital buffers and benefits from a strong liquidity position, with funding remaining well-diversified.

During the first quarter, our asset base continued to expand, with net loans increasing by 2% sequentially and 7% higher year on year. Growth has been broad-based, with AED 20 billion in new credit extended during the first quarter, offset by AED 15 billion in repayments.

Customer deposits were up 1% sequentially and 19% higher than a year earlier, with CASA deposits increasing AED 5 billion during the quarter and accounting for 51% of the total. This is a notable achievement in the context of rising benchmark rates over the last 12 months and a testament to ADCB’s strong franchise.

The Bank has continued to take a disciplined approach to managing its cost base in light of the global inflationary environment. In the first quarter, operating expenses reduced 5% sequentially, with the cost to income ratio improving to 31.5% from 38.1% a year earlier.

While the Bank is successfully delivering growth, we are also ensuring that our business is sustainable. Having embedded ESG into our corporate strategy, the Bank is stepping up green financing initiatives to support clients in their decarbonisation journey. To reinforce this commitment, in January ADCB signed the UAE Climate-Responsible Companies Pledge with the Ministry of Climate Change and Environment in support of the UAE’s net zero ambitions.

With the UAE hosting the COP28 global climate conference in November, ADCB stands ready to channel the expertise and dedication of our teams to support investment into a cleaner, increasingly diversified economy.”