PayerMax's Partner, COO, Essay Zhu, will attend a discussion on how PayerMax is leading the future payment solutions inline with evolving preferences of global consumers and demands of Saudi consumers

2 September, Riyadh, Saudi Arabia: PayerMax, a leading global provider of payment solutions, today announced its participation in the 24th Fintech event to showcase its unique position in bolstering the digital economy of the Kingdom, in line with the Saudi Vision 2030. Slated for September 3-5, 2024, at the Riyadh Front Exhibition and Conference Center, PayerMax's participation will emphasize their alignment with the Kingdom's digital aspirations and their contribution to the burgeoning market potential for digital transactions in Saudi Arabia.

PayerMax's Partner, COO, Essay Zhu, will appear in a panel discussion titled “Shaping Tomorrow’s Financial Services With Future Payments Infrastructure.” Her insights will enlighten attendees on how PayerMax's revolutionary payment solutions cater to the evolving preferences of global consumers and demands of Saudi consumers, resonating with the Kingdom's objective to transform to 70% of its transactions to cashless mediums by 2030.

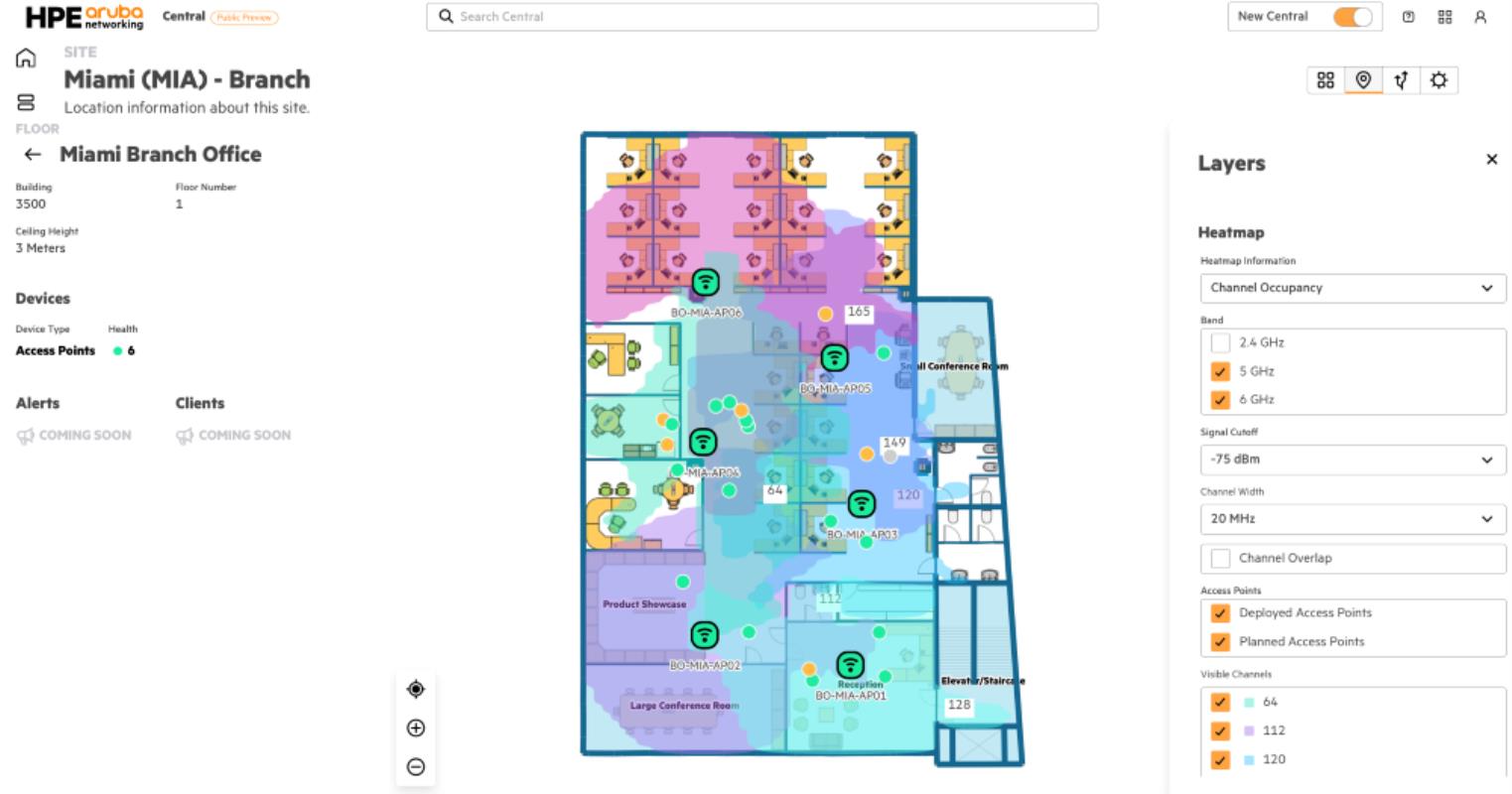

PayerMax is set to engage with key stakeholders, showcasing its innovative payment solutions that are driving the advancement of the fintech landscape both regionally and internationally. As a leading omni-method global payment provider, with over 600 payment methods and supporting 70+ transaction currencies, PayerMax is focused on empowering the borderless growth of the world’s fastest-growing digital merchants in emerging markets.

In showcasing its Value-Added Services Matrix during the event, PayerMax will offer a variety of robust offerings beyond global acquiring, payouts, and fund management. The company has an array of value-added services, including risk management, foreign exchange management, payment marketing (webshop), and finance & tax services, constructing a comprehensive environment for merchants to excel in a competitive global marketplace and handle the intricacies of globalization with ease.

Wang Hu, Co-Founder of PayerMax, said: “Our participation in the 24th Fintech event is a testament to our commitment to supporting Saudi Arabia’s Vision 2030. The Kingdom is leading the charge in digital innovation, creating a vibrant and dynamic economy that offers unparalleled opportunities for growth.”

“As the very first Asian fintech company to participate in the Regional Headquarters Program (RHQ) and obtain an RHQ license in Saudi Arabia, , we are proud to align our solutions with Saudi Arabia’s forward-thinking vision, helping businesses manage risk more effectively, navigate the complexities of globalization for sustainable growth and harness the full potential of this transformative era. We embrace the opportunity to play a pivotal role in the Kingdom's digital revolution, contributing to an economy marked by expansive potential,” he added.

Highlighting the potential for growth in digital payments, with the total transaction value in the digital payments market is projected to reach $63.90 billion in 2024, PayerMax's role in driving this trajectory is significant. The market is expected to grow at an annual rate of 8.06% from 2024 to 2028, reaching a total transaction value of $87.14 billion by 2028. PayerMax has introduced embedded payment technologies facilitating seamless integration into merchants’ websites and apps. This innovative approach not only supports diverse payment methods - cards, digital wallets, bank transfers, and even cash payments in various countries - within a unified framework but also enhances the consumer experience, fostering convenience at every transactional touchpoint.

With a vision to empower local businesses in the Kingdom, PayerMax aims to connect them to the global marketplace via leading-edge cross-border digital payment solutions tailored to their unique requirements. The platform's proficient handling of an array of local and international payment methods enables businesses to broaden their customer base and bolster revenue streams. It simplifies cross-border transactions, carving out time for businesses to dedicate to innovation and expansion.