Bahrain’s approach on Value-Added-Tax (VAT) revenues is based on transparency, clarity and continuous engagement with taxpayers, Finance and National Economy Minister Shaikh Salman bin Khalifa Al Khalifa has said.

In a written response to Parliament’s services committee vice-chairman Abdulwahid Qarata, Shaikh Salman disclosed that VAT revenues have generated more than BD1.7 billion for the Treasury since 2022

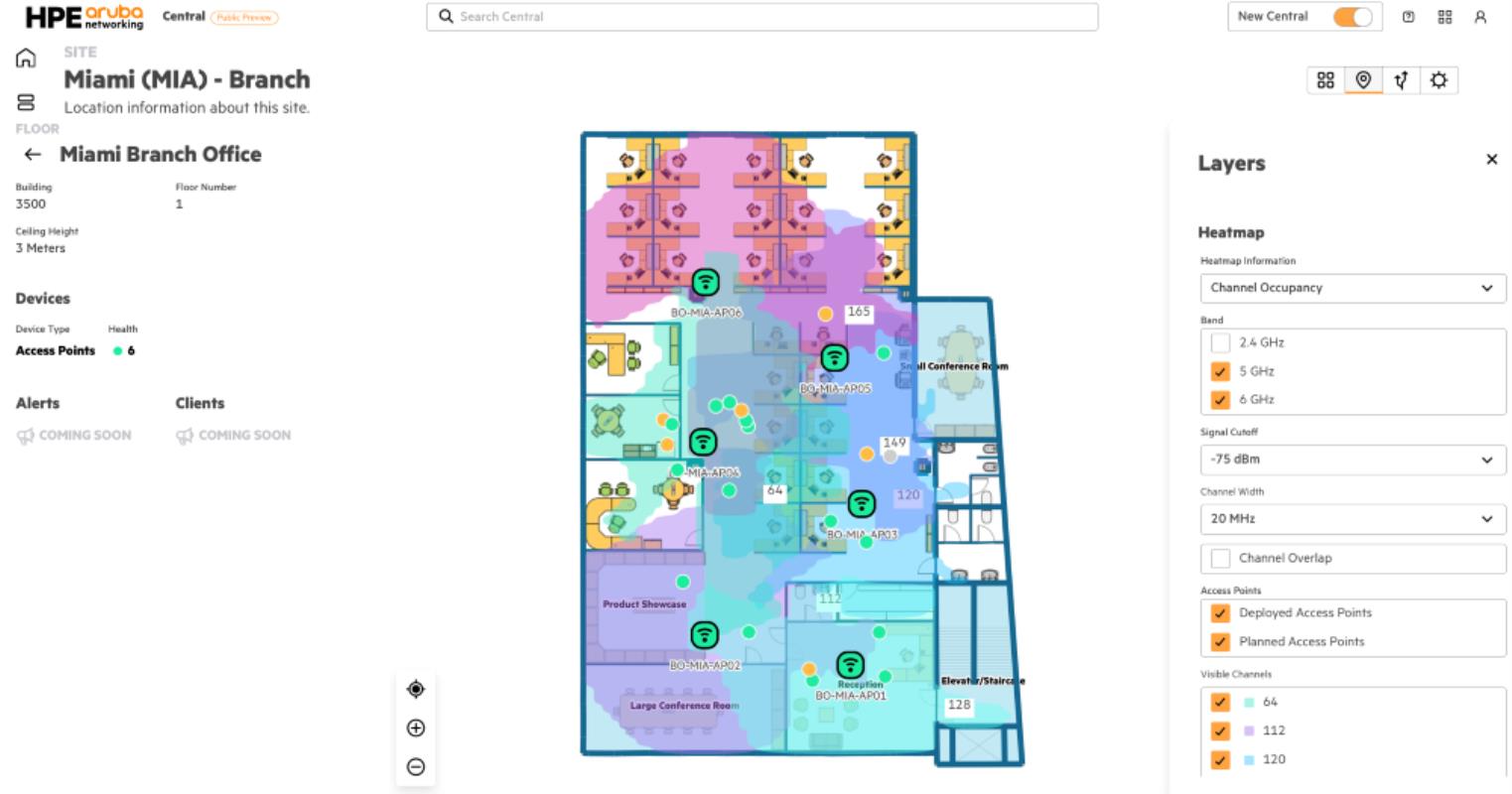

The minister explained that VAT management and collection are carried out through an integrated digital platform that allows businesses to complete registration, filing of tax returns and payment of dues electronically, reducing manual intervention and administrative errors.

To support compliance, the Bureau publishes detailed guidance manuals, practical instructions and frequently asked questions, which are regularly updated to reflect changes in practice and interpretation.

“Providing clear guidance enables VAT payers to fully understand their obligations, which in turn strengthens voluntary compliance,” Shaikh Salman said.